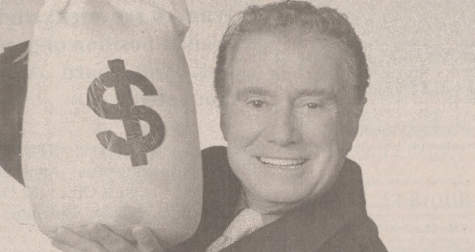

Addressing your financial future

By Katey Meisner

Contributing Reporter

All you need to become an investor is $25 a month, time and a little patience, according to Sean Hetherton, financial advisor for Edward Jones in Walled Lake.

Investing young has become progressively more important as the Social Security Administration is projecting a 26 percent decrease in benefits for Americans retiring after 2040.Â

This percentage is expected to continue to rise each year thereafter, according to Hetherton.

Achieving success as an investor relies largely on the state of the economy. However, by the same token, involvement by individuals in the economy is of great benefit to its health.Â

“Many investors are shocked at what their money can grow to,” Hetherton said of modest investors. Â

Hetherton advises young investors to start early and start simple. Â

“Invest for the long term and in something that is of interest to you,” he said.Â

Investing is something that can be done without the help of an advisor if an individual has the knowledge and time to commit to it. If not, financial advisors like Hetherton are available to help manage investments. Â

Hetherton recommends that a potential investor start by interviewing more than one advisor. Investors should discuss their needs and expectations with the advisor.

>Â

What to buy should never be discussed in a preliminary meeting. More importantly, an investor should discuss expectations as far as contact with the advisor and payment options. Â

Financial advisors can be compensated several ways depending on the client, so it is important to discuss this before making a decision.Â

Following the interview process, and once an advisor has been selected, the investor should deposit their investment into an account, be it $25 or $2500. From there, the investor could expect to receive regular statements showing activity on the account. Â

“The process is easy,” Heatherton said.Â

He warns not to be overly concerned about day-to-day dips in the stock market. Instead, he suggests an investor be concerned with the long term, and more importantly, overall state of the stock market as retirement approaches.Â

e=”margin: 0.0px 0.0px 0.0px 0.0px; line-height: 10.0px; font: 9.0px Book Antiqua”>

For a young investor, Hetherton recommends a mutual fund. He described a mutual fund as investing in an assortment of stocks to form a well-rounded portfolio, as opposed to investing in one individual stock. This is called diversification and it is a style of investing that often proves more successful in the long run.Â

Using this logic, an investor would not be devastated by the decline of one stock since the investment is split into as many as 100 to 150 stocks.

<

SPAN style=”; font-family: Century Schoolbook; font-size: 9.5px; text-indent: 8px; “>Leanne Caliendo, a 22-year-old senior at Oakland University, began investing in the stock market seven years ago. She originally invested with the help of her father, but later took control of her own investments.Â

“I started doing it on my own when I was 18,” Caliendo said. Â

class=”khtml-block-placeholder”>

Caliendo is invested in mutual funds and has watched her investments grow over the years.Â

Kevin Blades, a manager from Livonia, is an investor who began saving and investing independently in his mid-20s.Â

“I keep my investment level fairly consistent, and then I increase it by investing tax returns and annual salary increases,” he said.Â