The stock market is fine, what about the economy?

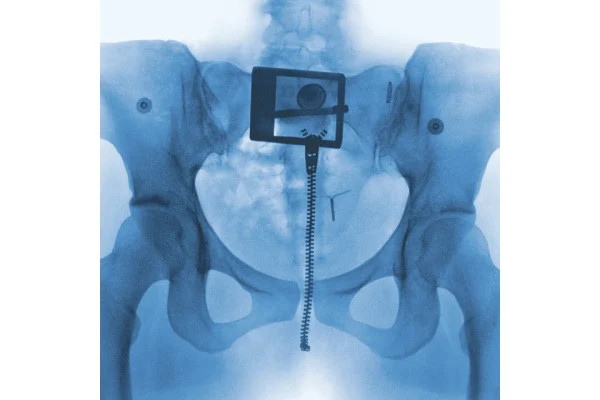

2020 was full of unprecedented events. COVID-19 caused over 530,000 deaths and weakened the economy in the U.S.

As we slowly recover from the pandemic with the vaccine and new $1400 stimulus, investors expect a bright future of the stock market.

The country is trying to improve the national economy, stimulus relief bills and the fast distribution of the COVID-19 vaccines are playing key roles in the recovery. As of March 12, more than 35 million Americans (10.5% of the population) are fully vaccinated. An increased number of people in public places such as shopping malls, theaters and restaurants is one of the signs.

While there are many signs of recovery, they also signal inflation. As an example of inflation, starting from late February, the yield of 10 year-treasury-bond quickly increased up to 1.6%. This has caused a tantrum in the stock market: approximately 10% of drop in terms of NASDAQ index.

Some investors anticipate that the FRB would execute monetary policies such as Yield Curve Control (YCC) or Operation Twist to stabilize the yield of the 10 year-treasury-bond and the stock market. Realistically, however, it doesn’t seem as the FRB is executing these policies to support the stock market prioritizing it over recovery of the national economy.

At the beginning of the pandemic, anxiety and fear from COVID-19 caused S&P (Standard and Poor’s) 500 index — a market-capitalization-weighted index of the 500 largest U.S. companies — to plunge 35%.

Shortly after, however, the Federal government and the Federal Reserve Board (FRB)’s quantitative easing has led the stock market to unexpectedly rally in V-shape and eventually to exceed the index level before the pandemic due to optimism vaccines will help return the world to normal in the new year and businesses will do well.

Everything happened in a blink of an eye, even before the recovery of the national economy. As soon as the stock market began recovering, many investors received a capital gain, and turned greedy with the expectation of continuous growth of the stock market.

Currently, there are many signs that the economy is improving, which can also bring a positive impact on the stock market in the long term. However, some investors are near-sighted as they only focus on the crushed stock market.

At one point, a question we need to ask ourselves is what is more important for the country, the stock price or recovery of the economy? Though the stock market is important, the recovery of the economy can support the stock market. The stock price, however, cannot directly improve the national economy.

One piece of good news is that soon enough, we all will be able to gather, laugh together and spend the time with our loved ones in a world where no mask is required. Looking at the speed of how this country has been recovering from a global pandemic, this is all very possible.

“Every day that goes by that we keep the lid on things will get better and better because we’re putting now at 2 million vaccinations into the arms of individuals each day, and as the days and weeks go by, you have more and more protection, not only of individuals, but of the community,” Dr. Anthony Fauci, chief medical adviser to President Biden, said. “So, we’re going in the right direction. We just need to hang in there a bit longer.”